private reit tax advantages

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. The income generated by REITs is not taxed on the corporate level and is instead taxed only on the individual shareholder level.

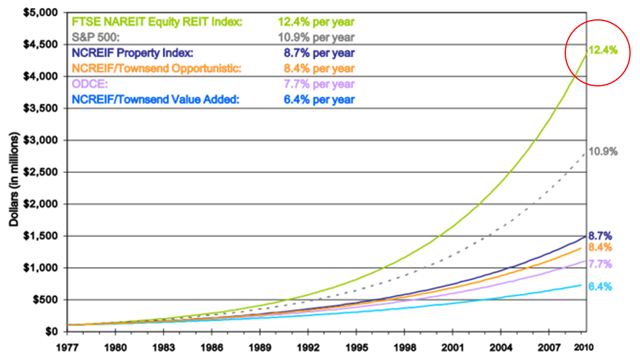

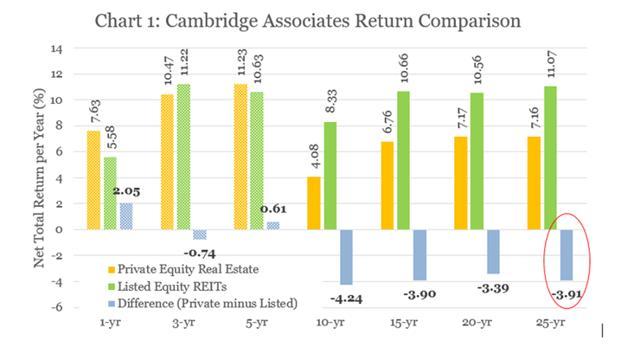

Why Reits Earn Higher Returns Than Private Real Estate Investments Seeking Alpha

Based on a REITs long-term capital gains its dividends may be taxed at long-term capital rates.

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

. Tax Advantages of REITs. Private REITs can also pass through a myriad of other tax-advantaged situations like Opportunity Zones and 1031 Exchanges to name a few. The private equity firm passes all tax benefits on to its investors including depreciation and capital recapitalization while REIT payouts are taxed at an investors higher ordinary income.

Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. Subsequent changes to the regime have been designed to make the REIT more attractive the most recent being the relaxation of certain of the REIT conditions made by Finance Act 2022 FA 2022. Ad Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios.

No corporate income tax. Specifically tax-exempt and foreign investors have historically been the key driver behind fund managers implementing this structure because of the tax benefits that have been afforded to those investors. A benefit of investing in a fund with exposure to multiple properties is built-in diversification without the headache of multiple state income tax filings.

REITs are partial conduits. No excise tax on gas or. The balance of a REITs dividends are taxed as ordinary income.

Zero tax on out-of-state retirement income. They are able to generate risk adjusted returns primarily through rental income but also through the appreciation of held real estate assets. In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits.

Tax Advantages of REITs. In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits. In their simplest tax form a REIT functions like a hybrid of the two and provides the best.

From a tax perspective they offer benefits that are similar to those of public REITs. Form 1099-DIV is issued to persons who have been paid. REIT investors can deduct up to 20 of ordinary dividends before income tax is assessed.

The use of real estate investment trusts REIT in real estate private equity fund structures has long been advised as a prudent strategy. Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives. The list below summarizes a few of the main advantages of starting a private REIT.

Specifically REIT profits pass through untaxed to shareholders via dividends. Another advantage of REITs is that they must annually distribute almost all of their rental and capital income as dividends to shareholders which results in. A REIT Real Estate Investment Trust is a tax-advantaged investment vehicle created in 1960 as part of the Cigar Excise Tax Extension with the purpose of buying and holding real estate.

Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1 million excluding primary residence or with income exceeding 200000 over two prior two years 300000 with a spouse. REITs are partial conduits. Private Real Estate Investing.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. If you hold an asset for a year or more you will pay long-term capital gains tax which is much lower than ordinary income. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates.

REIT investors can deduct up to 20 of ordinary dividends before income tax is assessed. Shares are not traded. Tax-exempt sales of real estate.

Tax advantage of REITs. The second primary advantage is long-term capital gains. REITs function like a blocker corporation in a real estate investment fund so setting up the REIT as the investment entity reduces the number of entities needed in the structure.

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. Heres my two cents on private REITs. Its shareholders are taxed on dividends received.

There are limits on the ownership and transferability of Brookfield REITs shares. Preferred shares in addition to five. A notable advantage of REITs is the ability to characterize a portion of distributions that would otherwise be treated as ordinary income as ROC due to real estate-related factors such as depreciation and amortization.

Ad With Decades Of Experience Let Cornerstone Help With Tax Advantaged Investments Today. Limited partnerships and limited. For example in the last three years our REIT has had 66 growth in value thats roughly 15 growth year-over-year.

The announcement that the UK corporation tax rate is to increase from 19 to 25 from April 2023 has created a renewed buzz of interest in REITs. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. The top 2 best private REITs for investors are Streitwise and RealtyMogul.

Lets dive right in. No personal income tax. A benefit of investing in a fund with exposure to multiple properties is built-in diversification without the headache of multiple state income tax filings.

Here are my top 10 Wyoming tax-friendly policies. ROC distributions are tax deferred until redemption at which time they give rise to capital gain. Tax benefits of REITs.

Ive evaluated many private REITs and Id. Ordinary dividends from a REIT are not subject to foreign withholding. In many cases such as with ours a private REIT can not only provide investors with income distributions but also with terrific growth.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Individual REIT shareholders can deduct 20 of the taxable REIT dividend income they receive but. Private REITs are typically more exclusive and may not be accessible to everyone.

Tax-free earnings from intangible assets. Borrowing also increases the risk of loss and exposure to negative economic effects. Entities qualifying for REIT status under the tax code receive preferential tax treatment.

Cornerstone Combines The Power Of 1031 Securitized Real Estate. But if you paid 100000 for that same investment you are getting a 2 yield. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do.

Which one is best for you depends on your goals and your investment potential. The second way is to. A REIT unlike a regular corporation deducts dividends paid.

The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. From a tax perspective they offer benefits that are similar to those of public REITs.

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

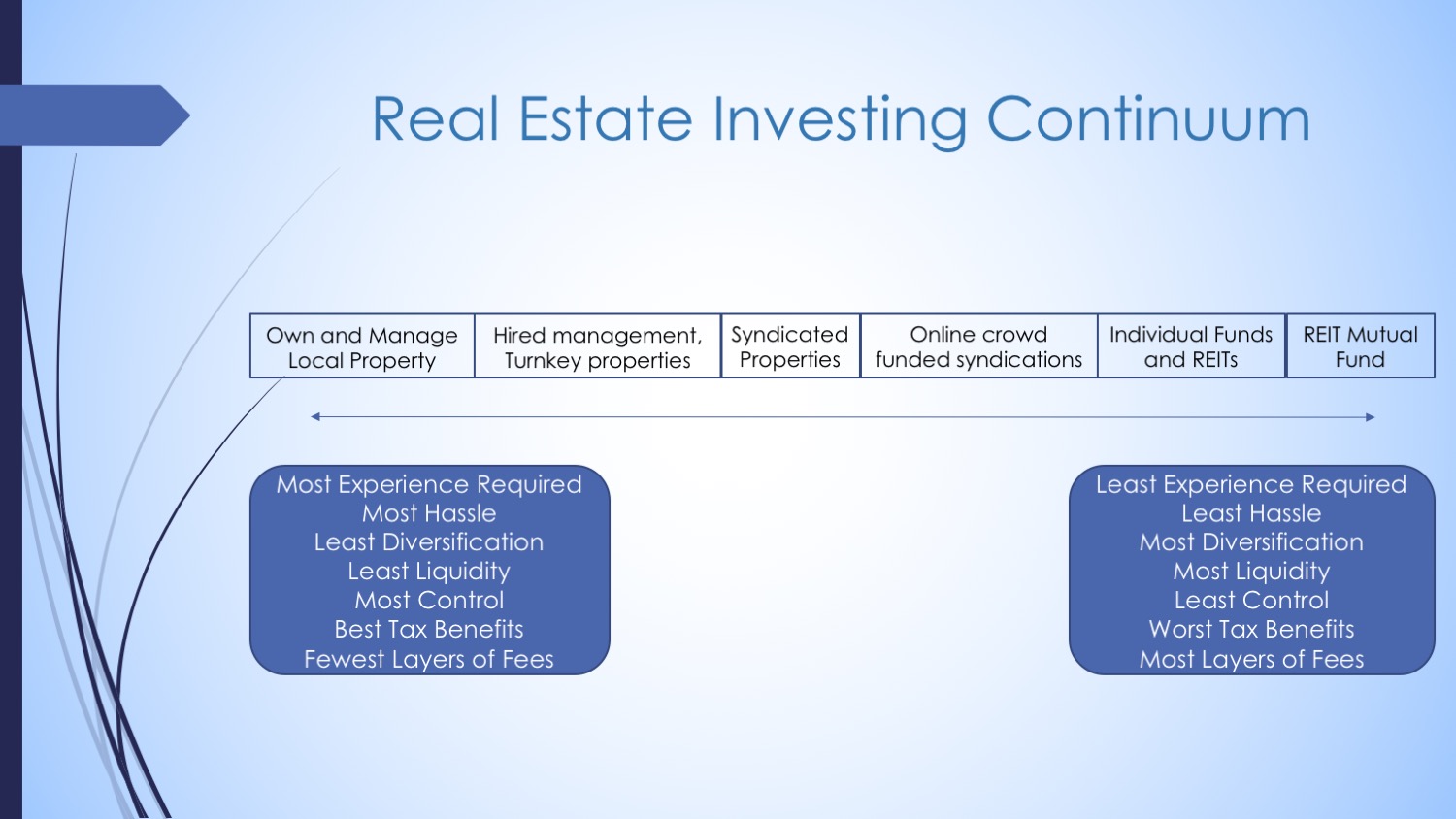

How We Invest In Real Estate White Coat Investor

Create Massive Leverage Through Passive Real Estate Investing Video Real Estate Investing Investing Real Estate Investor

Restricted Stock Learn Accounting Finance Investing Accounting Basics

How Is My Arrived Investment Taxed Arrived Homes Learning Center Start Investing In Rental Properties

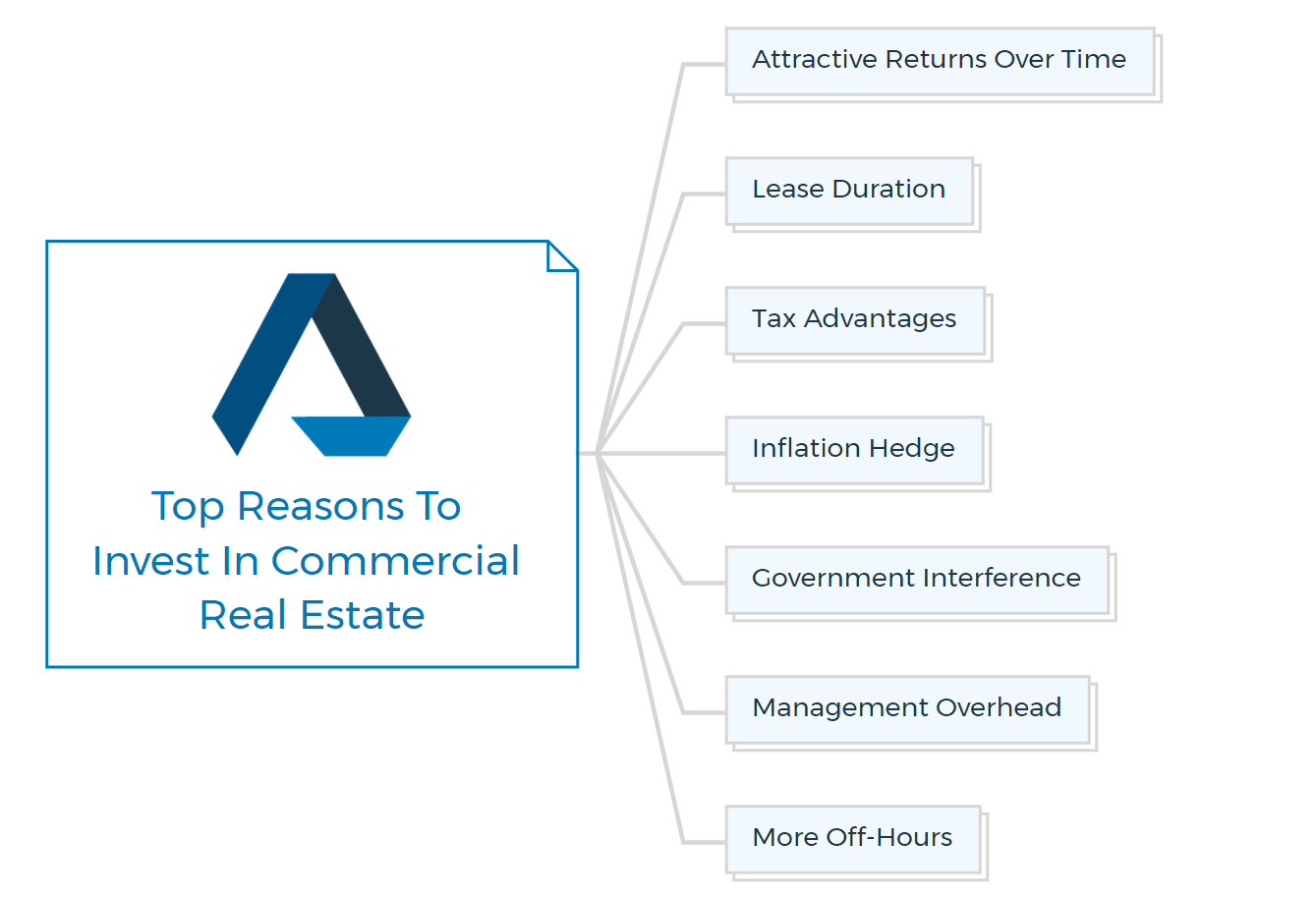

13 Golden Rules Of Investing In Commercial Real Estate

Restricted Stock Learn Accounting Finance Investing Accounting Basics

Is My Lawsuit Settlement Taxable

13 Golden Rules Of Investing In Commercial Real Estate

Why Reits Earn Higher Returns Than Private Real Estate Investments Seeking Alpha

Why Reits Earn Higher Returns Than Private Real Estate Investments Seeking Alpha

How Is My Arrived Investment Taxed Arrived Homes Learning Center Start Investing In Rental Properties

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

Why Reits Earn Higher Returns Than Private Real Estate Investments Seeking Alpha